There are loads of tips out there on how to save money fast but – and it’s a big but – lots of them, don’t help lots of us save money quickly

Now don’t get me wrong, many of these money saving tips are very sensible and will help us save money in the long term but unfortunately they actually get in the way of us slashing our spending right here, right now!!

The problem is nearly all these tips tell us to start saving money by writing a budget. Budgets are a good thing – a very good thing – but many of us find budgeting overwhelmingly scary and because it is overwhelming we either:

- Drown in the detail, wasting time struggling with tiny savings that don’t help us save money fast,

- Or we just bury our head in the sand and do nothing because we’re too darn scared to face up to the financial mess we’re in!!

Now, of course, we do all have to face up to our financial reality however horribly, horribly messy it is. It truly is essential for our long term financial and mental wellbeing – it is basic self care when it comes down to it – but it is easier to do this – and to start budgeting – with some big quick money saving wins under our belt.

So I am going to show you how to save money fast in 7 simple steps.

But these super quick money saving tips won’t just show you how to save money fast, they’ll actually give you the momentum and self confidence you need to start working on a budget and to save a lot more money going forward.

Now advance warning : the first three will sound dull. Very dull. But they are key. They save money fast and they keep saving money week, week out. So don’t skip them!!

I really hope these tips help you save money fast. For more help do check out my other simply frugal tips & follow me on Pinterest.

How To Save Money Fast

These seven money saving tips will help you cut your spend instantly. To make them manageable try putting aside 30 minutes a day and focus on one each day. Within just one week, you will be able to cut your spending without getting overwhelmed and you can then move onto the next stage in your money saving journey with more confidence that you will succeed …

1. Write An Eat Up Plan

We all have to spend money on food. It’s our most basic need. But many of us waste lots of money every week chucking food out. So get in the kitchen with a sheet of paper & write a quick eat up plan:

- Check your fridge, freezer & cupboards for anything about to expire

- Root around for forgotten stuff

- Get it in plain sight so you don’t forget it again – I have an “eat up” shelf in the fridge that helps

- Jot it all down in a list

- Then throw together a quick plan for eating this stuff up before you spend any more money on any more food.

Meals will be a bit weird and wonderful but you’ll be surprised how long you can go without spending more or much. And this simple exercise can transform our mindset about how much food we need to buy. It saves us money instantly, but week in, week out it can save us thousands over a year as we stop buying food we don’t need and will never eat.

2. Write A Food Loop

Our next step is to write a simple food loop.

What’s a food loop you ask. Well to start with, it’s not a fancy meal plan we will never ever stick to. It is simply a list of 7 healthy but filling main meals your family enjoy that you can cook from scratch – between you – with very little effort in less than 30 minutes. All you’re going to do for the next month is loop through it. It won’t be wildly exciting but it will save money fast.

What we put on our food loop obviously depends on our cooking skills. It could be as basic as:

- Jacket potatoes with tuna & coleslaw

- Baked beans on toast

- Omelettes

- Etc

It’s up to you. It just has to be simple because simple meals from basic ingredients the whole family can help make:

- Save money in themselves

- Keep shopping & bargain spotting simple

- And when we’re tired and stressed stop us from reaching for the ready meals and the take aways that devour so much of our cash.

A simple food loop – you can always expand it later – also saves money by cutting food waste because it makes it much easier to use up leftovers either for lunches or by getting creative rehashing things.

Which takes us onto step three which is writing a leftover plan.

3. Write A Leftover Plan

Eating up leftovers first is an amazingly easy way to save money fast. And also save time.

The simple rule is: only move onto the next meal in your food loop when you’ve eaten up all your left overs.

Sounds dull, huh? But you know what there’s all sorts of meals that taste just as good if not better on the second day for lunch and there are all sorts of clever ways to eat up leftovers that are totally yummy:

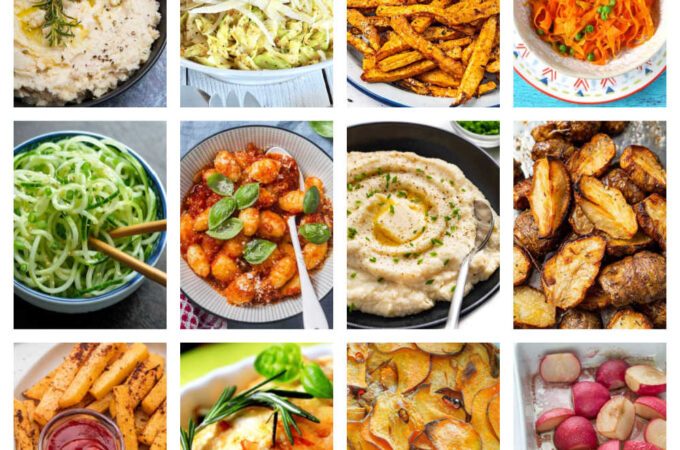

- leftover potato can become everything from fish cakes & hash browns to potato cakes, gnocchi & frittata

- soggy veg can blended into quick soup, pasta sauce or curry with some lentils or pulses chucked in for protein

- tiny scraps of cheese or fish or ham are amazing in an omelette

- dry bread ends make a fab crumble topping for leftover fruit.

The trick to eating up leftovers is not complicated recipes, just a super simple list of what to do with leftovers from each meal on your meal plan plus basic leftovers like milk, cheese, fruit and bread.

Because it is written down we don’t have to angst about what to do with our leftovers, we just do it. It’s instantly easier. And it saves an unbelievable amount of money fast because we:

- Stop throwing food away

- And need to buy much less food.

For inspiration check out these ideas for using up leftovers …

4. Slash Your Shopping List

Getting on top of our food shopping truly can save us a lot of money every month and getting on top of our other household shopping can save us even more.

The thing is, we all spend crazy amounts of money on household items and toiletries we don’t use or could actually do without. So step 4 in this simple plan for saving money fast is to sit down for 10 minutes or so and write a very simple shopping list.

When money is really tight we honestly can get by with just these basics:

- Toilet paper

- Laundry soap

- Dish washing liquid

- Baking soda (it’s a natural disinfectant)

- Soap

- Shampoo

- Toothpaste

- Deodorant

We can manage without fancy cleaning products, disposable cleaning cloths, kitchen foil, freezer bags, fabric conditioner & a whole bunch of other things we’ve been conned into thinking are “essential”.

To help you slash your shopping list, I’ve got a big list here of 101 things we do not need to buy and can manage without.

You might not feel up to cutting right back to the basics but the more we simplify our shopping list, the easier it is to spot genuine bargains on the real essentials that save even more money. Cutting out all the crazy products we buy also instantly frees up cash to bulk buy essentials and save yet more.

5. Cancel Cable

The first four steps in our save money fast plan are simple but do need us to shift our mindset about how much we really “need”.

Step five, however, is a cinch : cancel the cable we all keep spending more and more one every year. You could downgrade to Netflix or Hulu or something cheaper. You can find a whole bunch of tips here on cheap alternatives to cable if you’re not up to going cold turkey on all your favourite shows.

6. Get Smart With Your Phone

We’ve all been giving over more and more of our money every month to the phone companies as well as the cable TV companies.

We’re like frogs being slowly boiled in water who don’t notice the rising temperature!! None of us have noticed just how much more as a family we’re spending on phone contracts than we were even 4 or 5 years ago.

So step six is about taking back control & turning down the heat on our phone bills because they’re burning a whole in our pocket!!

Take 30 minutes to reduce your family’s monthly phone & broadband bills. You could:

- Cancel an unused land line

- Reduce your data allowance – use wifi wherever you can, disable apps that are using loads of background data & download maps for example on wifi before leaving the house

- Consolidate phones onto a single account

- Downgrade your cellphone account

- Switch kids to Prepaid

- Switch providers

- Negotiate a new deal with your provider

- Share broadband with a trusted neighbour

You don’t have to do everything, but do something quickly. And then put a weekly reminder in your calendar to spend another 30 minutes on it next week and keep turning that heat down.

7. Brainstorm Biggies

Most financial advice tells us to go through every line in our bank statements and find all the little things we can cut.

We can save loads of money this way but, the honest truth is, loads of us are actually scared stiff of even opening bank statements!!! Or when we do open them, find our brain fogs over so we can’t focus and take action.

If this sounds familiar, I promise you, you are not alone.

We do need to tackle these issues but we won’t overcome them over night so to save money fast sit down for just 15 minutes with a blank sheet of paper and brainstorm some big monthly financial “leaks” you could stop now.

We’re not trying to capture all our spending just those £20-£30 items that go out month after month. They could be:

- Monthly charges e.g. membership, classes, sports tickets, hair appointments. Use this big list of things to cancel to help you.

- Every day small charges e.g. coffee, bottles of water, snacks, lunches

Jot them down quickly.

And when 15 minutes is up just run your eyes down the list and spot the easiest one to take action on right now. And do it. And cross it off.

And tomorrow, sort out the next easiest.

And the next day, the next. And so on.

Some things will be harder to sort out than others but by taking action every single day we build up momentum and it starts to become a habit. Good habits truly are amazingly powerful and every day we save a bit more money we will become more confident that we can save even more money.

The simple habit of completing one small money saving action every day can be life changing for all of us who are terrified of our finances,

Little by little we’ll build the belief in ourselves we need to

- Track & control expenditure

- Write & stick to a budget

- Earn extra money

- And start living a life we can sustain free from the fear of debt

I really hope this simple 7 step plan helps you work out how to save money fast in your life even if you struggled before.

For more help do follow me on Pinterest & check out these other simple frugal living posts:

- 14 Frugal Life Skills

- 30 Ways To Live Debt Free

- 50 Ways To Stop Wasting Money

- 8 Weird Money Saving Tips

- 30 Products That Save Money

- 75 Christmas Budget Tips

- 5 Ways To Save On Baby Stuff

Image source: rawpixel.com

Photo: Money in glass jar by Marco Verch under Creative Commons 2.0

Leave a Reply